Best invoice software for freelancers: 11 Free & paid tools [2026]

Run your productized agency with Assembly

Assembly gives you the tools you need to start, run, and grow your client business. Try it for free!

4.9 rating

- Best invoice software for freelancers: 11 Top options at a glance

- 1. Assembly: Best for freelancers who want invoicing inside a branded client portal

- 2. FreshBooks: Best for freelancers who need accounting and invoicing in one place

- 3. Wave: Best for budget-conscious freelancers just starting out

- 4. Bonsai: Best for freelancers managing proposals and contracts

- 5. HoneyBook: Best for creatives handling project-based work

- 6. Quaderno: Best for freelancers with international clients or tax compliance needs

- 7. Zoho Invoice: Best for small teams needing a free tool

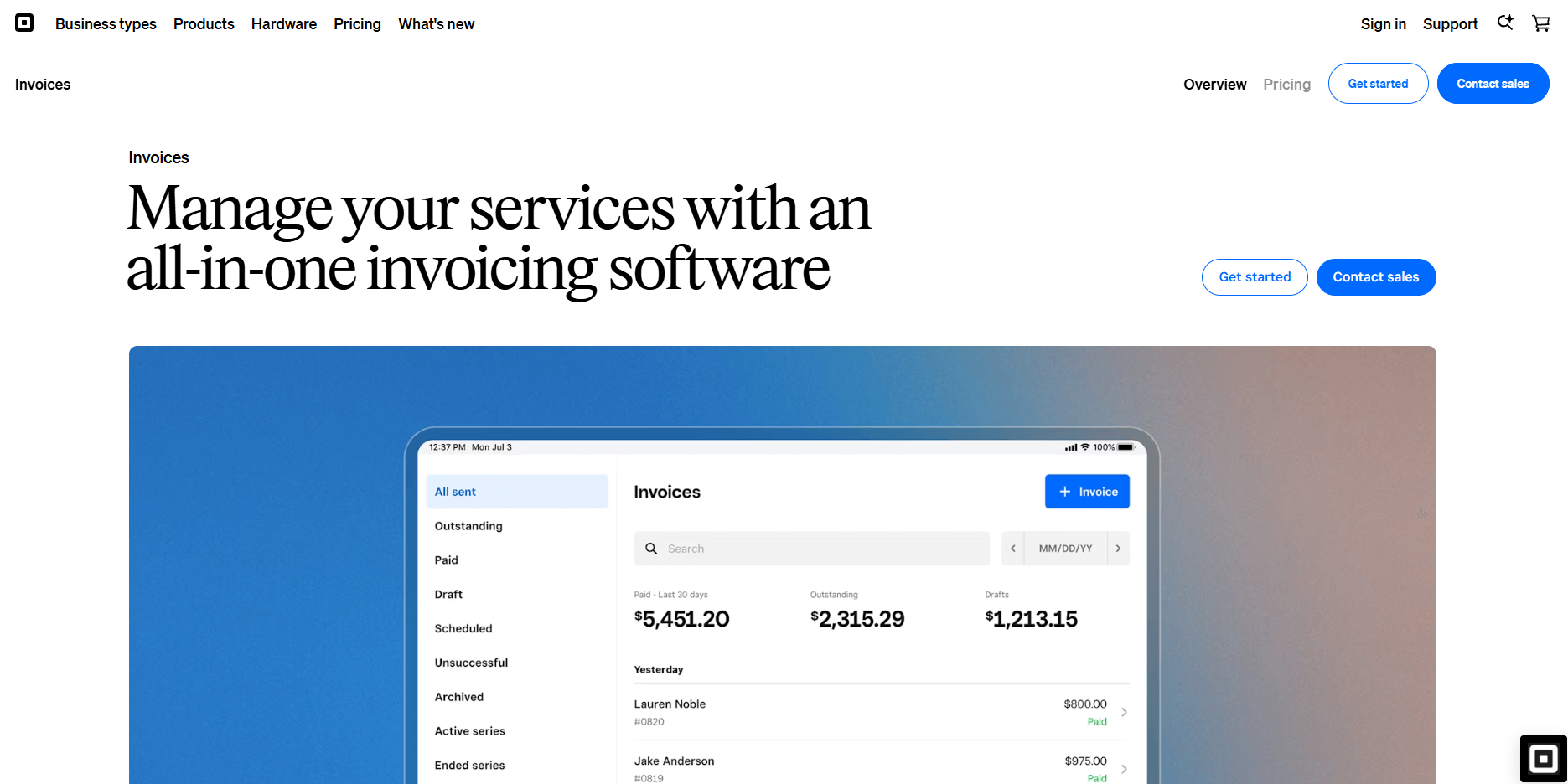

- 8. Square Invoices: Best for local service providers and on-the-go billing

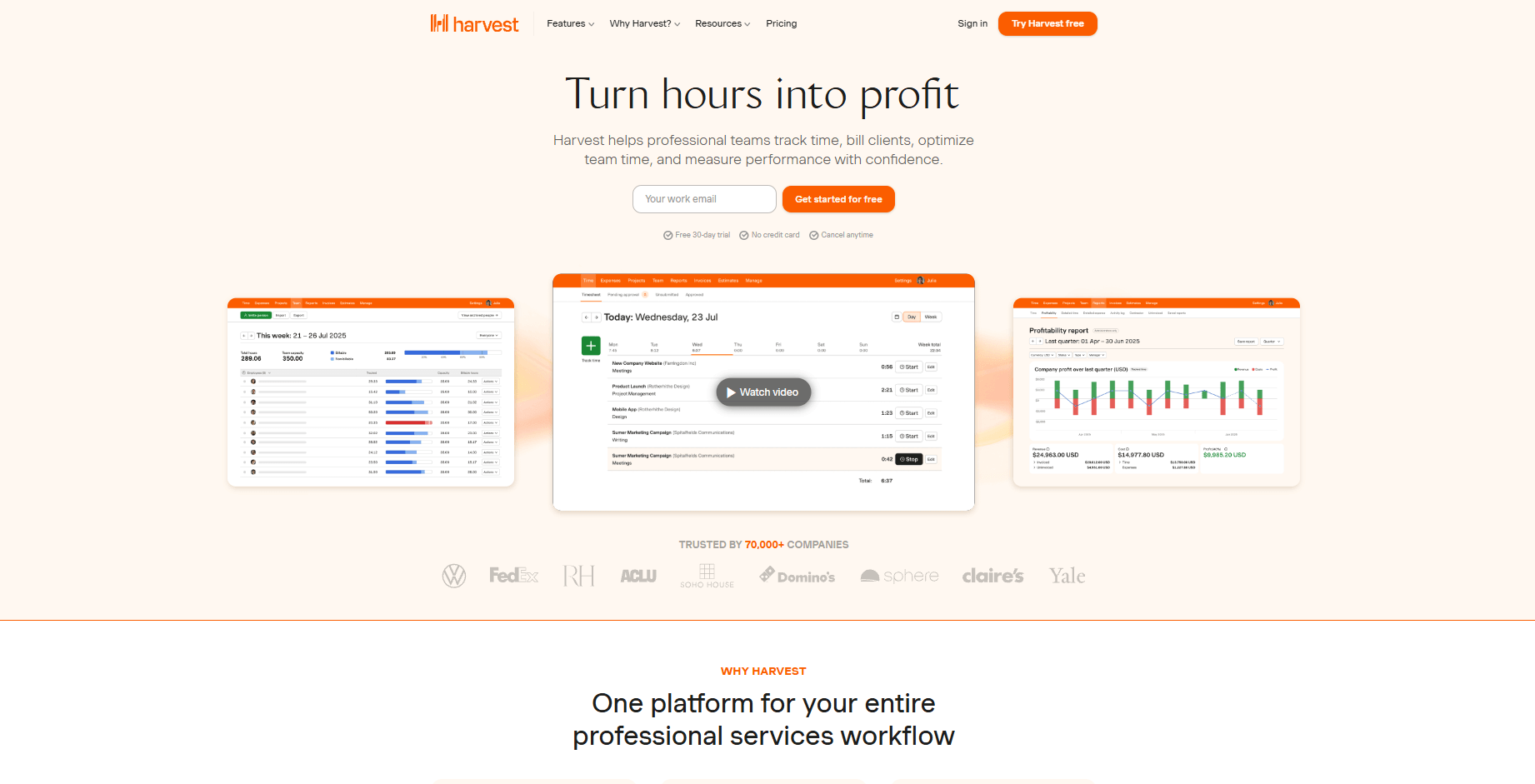

- 9. Harvest: Best for time-based billing and hourly work

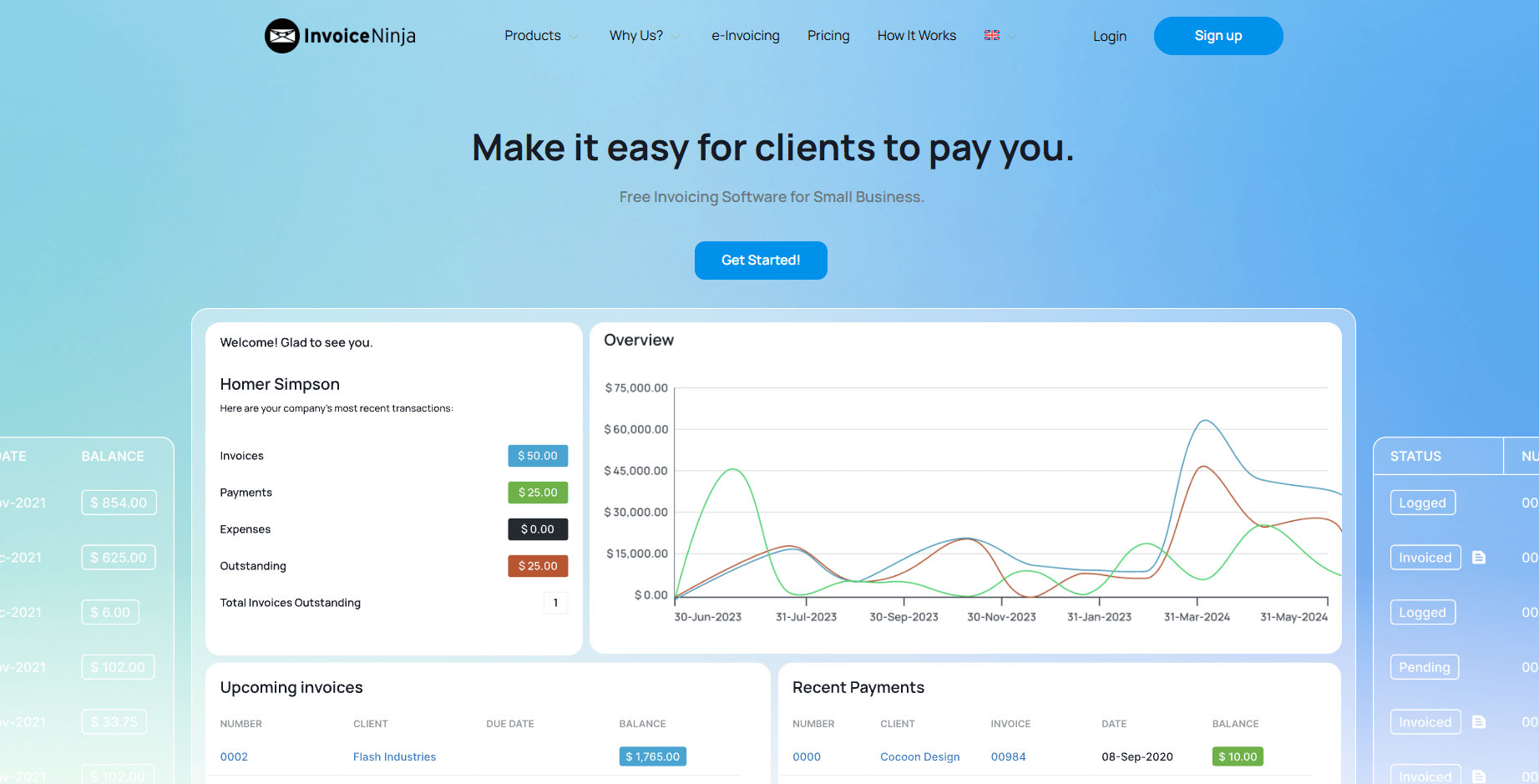

- 10. Invoice Ninja: Best for tech-savvy freelancers wanting customization

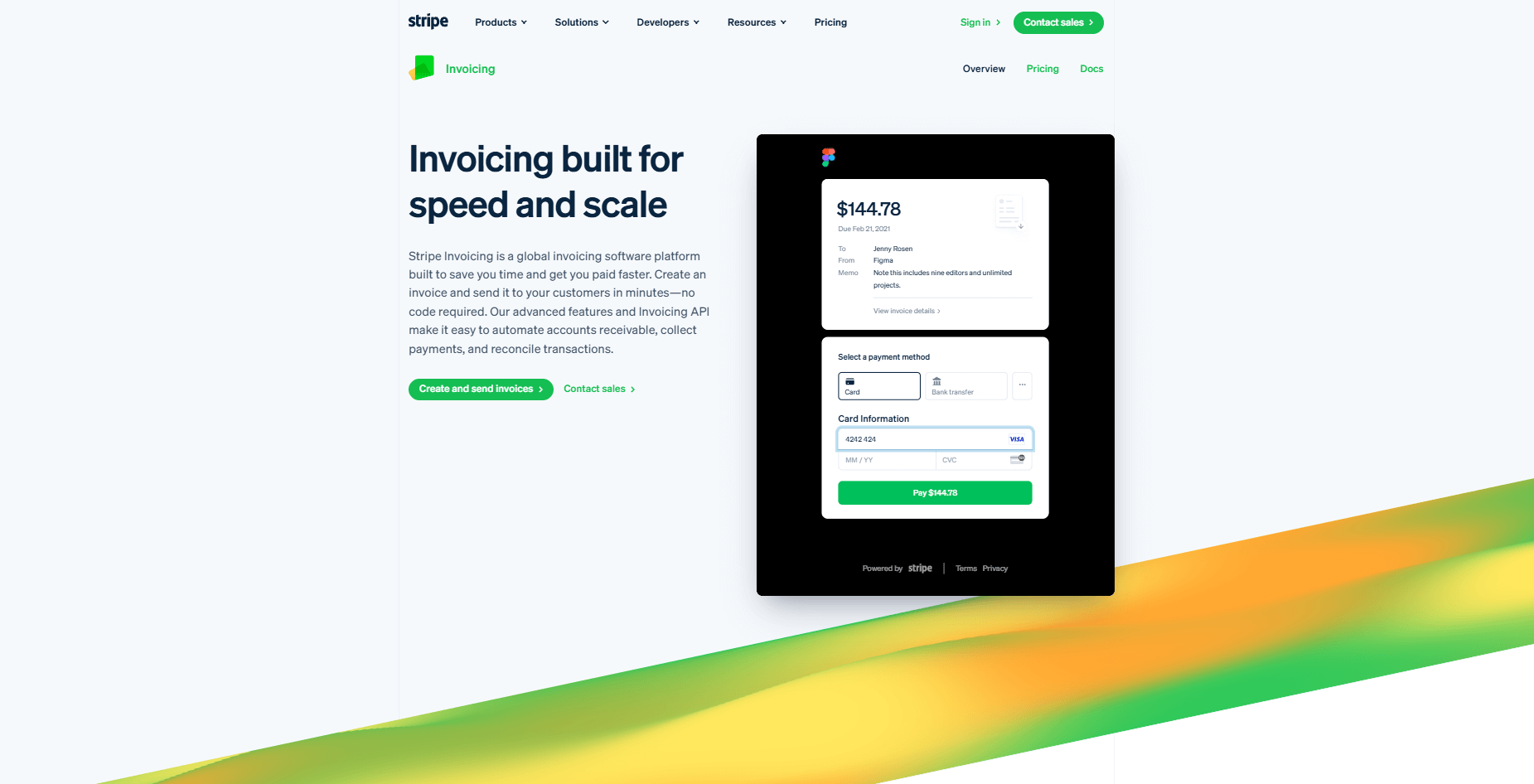

- 11. Stripe Invoicing: Best for freelancers with recurring revenue models

- How I tested the best invoice software for freelancers

- Which invoice software should you choose?

- My final verdict

- Want invoicing built into your client portal? Try Assembly

- Frequently asked questions

I tested dozens of the best invoice software tools for freelancers over the past few months, from bare-bones billing tools to full client portals. Here are 11 that cut down on admin time, speed up payments, and make your business look more professional in 2026.

Best invoice software for freelancers: 11 Top options at a glance

Invoicing platforms vary from basic billing tools to complete client management systems with payment automation and branded portals. These tools typically charge payment processing fees when clients pay online, though some platforms add their own fees on top of standard gateway rates.

Let’s compare them side by side:

| Tool | Best for | Starting price (billed annually) | Key strength |

|---|---|---|---|

| Assembly | Freelancers who want invoicing inside a branded client portal | $39/month | Brings invoicing, contracts, and client files into one portal that saves time on client management |

| FreshBooks | Freelancers who need accounting and invoicing in one place | $252/year | Connects invoicing, time tracking, and expenses in a single accounting dashboard |

| Wave | Budget-conscious freelancers just starting out | Free, then starts at $190/year | Unlimited invoices and accounting features at no monthly cost |

| Bonsai | Freelancers managing proposals and contracts | $9/user/month | Invoices with basic automation, templates for proposals and contracts |

| HoneyBook | Creatives handling project-based work | $29/month | Automates client workflows from inquiry to final payment |

| Quaderno | Freelancers with international clients or tax compliance needs | $29/month | Automatically calculates and applies sales tax to invoices for different countries and states |

| Zoho Invoice | Small teams needing a free tool | Free | Handles international invoicing and multiple payment gateways |

| Square Invoices | Local service providers and on-the-go billing | Free, then starts at $49/month | Mobile-friendly invoicing that works with Square's payment ecosystem |

| Harvest | Time-based billing and hourly work | Free, then starts at $9/seat/month | Connects time tracking directly to invoice generation |

| Invoice Ninja | Tech-savvy freelancers wanting customization | Free, then starts at $10/month | Open-source invoicing platform with extensive customization options |

| Stripe Invoicing | Freelancers with recurring revenue models | 0.4% per paid invoice | Built-in subscription billing and automated payment collection |

Note: All platforms charge payment processing fees when clients pay online. We’ll discuss the fees below when applicable.

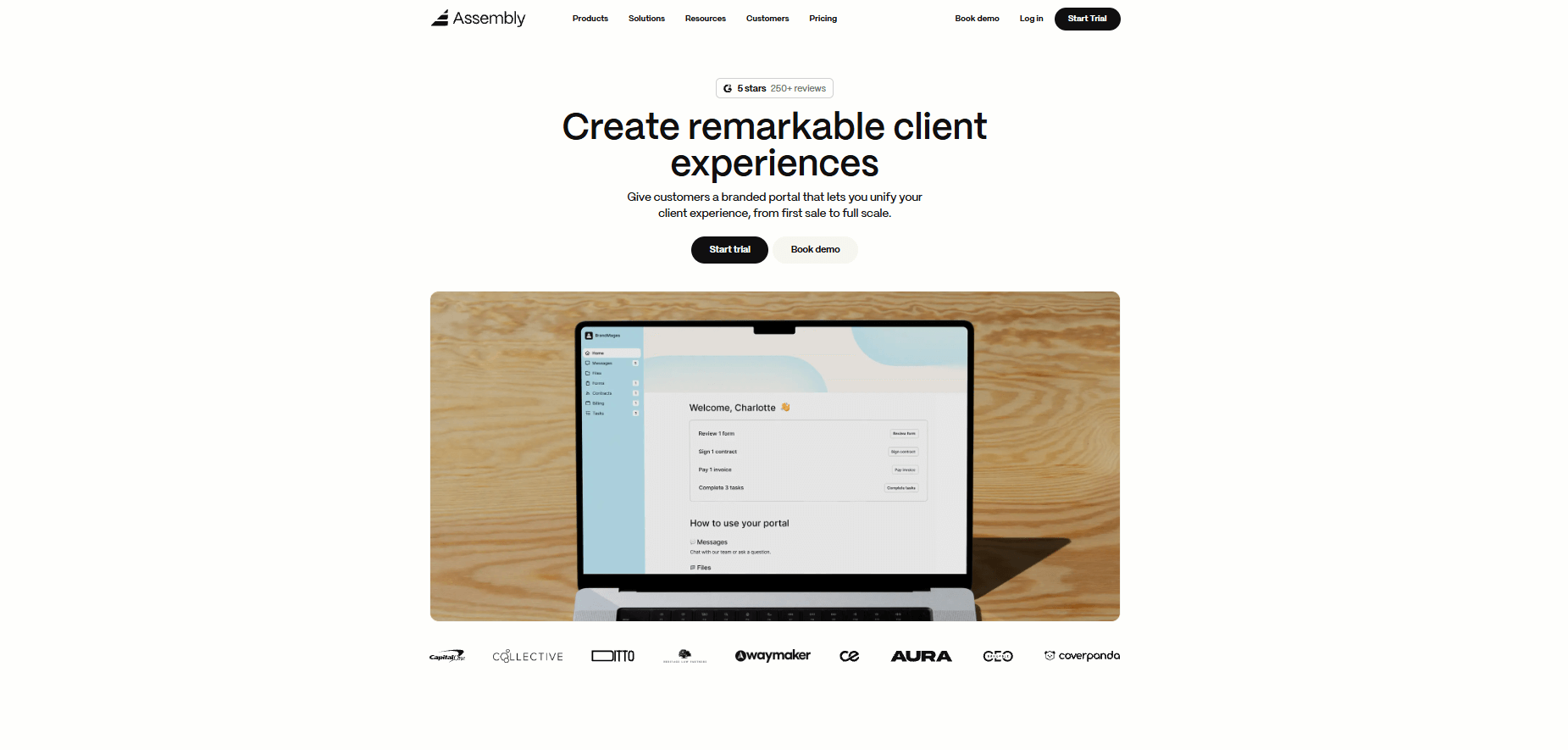

1. Assembly: Best for freelancers who want invoicing inside a branded client portal

- What it does: Assembly combines invoicing with a client portal where your bills appear alongside contracts, files, and messages. It connects billing to the full client relationship in one branded space.

- Who it's for: Freelancers managing ongoing clients who want to avoid switching between separate tools for invoicing, contracts, and communication.

Assembly is a branded client portal tool that gives your clients one professional space to access everything related to their account. We built it to handle invoicing as part of a complete client management system rather than as a standalone billing tool.

Our Billing app lets you send invoices that appear in your client's portal alongside their contracts, files, and message history. This connects payment requests to the broader relationship instead of treating them as isolated transactions.

You can also set up recurring invoices, one-time bills, and subscription-based pricing. Clients pay via credit card or ACH, view their full invoice history, and receive automated payment reminders without needing to dig through email.

The AI Assistant surfaces past payment patterns and notes before client calls, which helps you address billing questions with full context already in hand.

Assembly integrates with Airtable, Calendly, ClickUp, Zapier, and Make to keep invoicing connected to your other workflows.

Our App Store includes apps for tasks, files, forms, and messaging that work alongside the Billing app to manage the full client relationship. You can also commission custom builds through the Experts Marketplace for specialized invoicing workflows.

Key features

- Branded client portal: One login for clients to view invoices, contracts, and updates.

- Billing and contracts: Built-in e-signatures, invoicing, and recurring payments.

- AI Assistant: Surfaces client context, such as notes and payment history, before meetings.

- App Store and Marketplace Apps: Lets teams install prebuilt or custom apps to expand invoicing workflows, manage tasks, communicate with clients, etc.

- Integrations hub: Connects with various tools for automation and workflow syncing.

Pros

- Branded client experience that keeps all billing in one professional space.

- Reduces tool overload by combining invoices with contracts and communication.

- Integrates with ClickUp, Airtable, Calendly, and automation tools.

Cons

- Pricing reflects the full client management platform, not just invoicing features.

- Better suited for ongoing client relationships than one-time projects.

Pricing

Assembly starts at $39 per month, with payment processing fees of 2.9% + $0.30 per credit card transaction and 1% per ACH transaction (capped at $10). Assembly also charges platform fees between 0.3% and 0.5% on top of payment processing, depending on your plan tier. These cover invoice payments, subscription billing, and store transactions.

Bottom line

Assembly fits freelancers who want invoicing inside a complete client workspace rather than as a standalone billing tool. If you need a simpler tool focused purely on quick invoicing without the surrounding client management features, platforms like Wave might be a better fit.

2. FreshBooks: Best for freelancers who need accounting and invoicing in one place

- What it does: FreshBooks combines accounting, invoicing, and client portals into one platform. It's built to help service businesses onboard clients while tracking time and expenses.

- Who it's for: Accounting teams, consultants, and freelancers managing both client onboarding and financial tracking.

FreshBooks connects accounting directly to invoicing, which helps when new clients need quotes approved and payment details finalized during setup. I tested the workflow by sending a proposal, converting it into an invoice, and tracking payments in the same dashboard.

It works as a lightweight invoicing tool for firms that want to tie financial setup directly to client intake. The interface is clean and quick to learn, though it's not built for collaboration beyond billing.

I've seen teams appreciate how it shortens onboarding when finances are a key part of the client relationship.

Key features

- Client portals: Lets clients view proposals, invoices, and payments in one place.

- Expense tracking: Records and categorizes business expenses with time logs.

- Automated recurring invoices: Set up automatic billing for repeat clients.

Pros

- Combines onboarding and billing in one tool.

- Clear visibility into client payment history.

- Familiar, accountant-friendly interface.

Cons

- Limited communication and file-sharing tools.

- Not built for broader client collaboration.

Pricing

FreshBooks starts at $252 per year. Payment processing fees are 2.9% + $0.30 per credit card transaction and 1% per ACH transfer.

Bottom line

FreshBooks treats invoicing as part of your accounting system rather than a separate billing tool, which saves time when you need client payments tied directly to expense tracking and financial reports. If you need client collaboration features, Assembly offers a more complete client-facing experience.

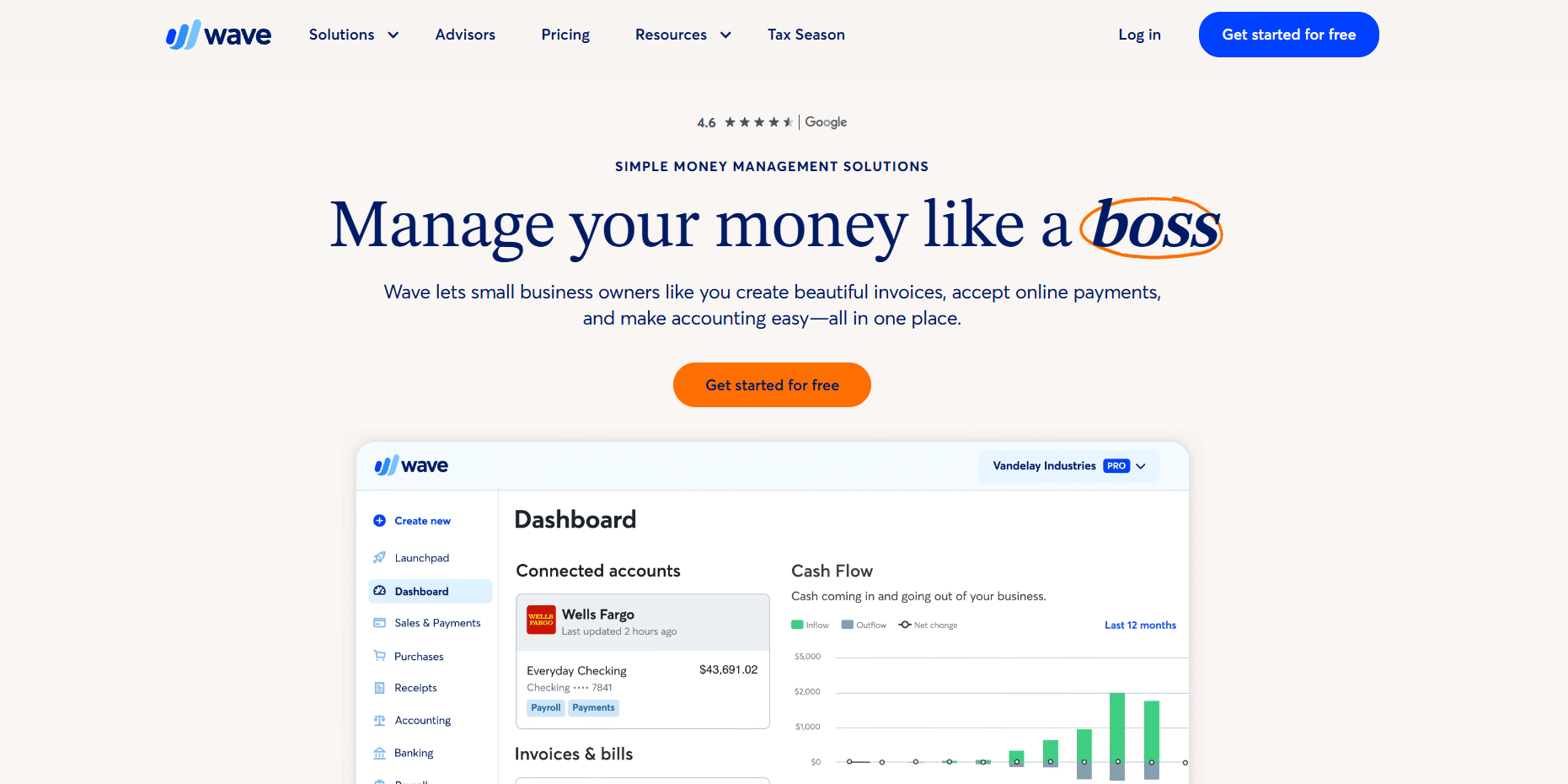

3. Wave: Best for budget-conscious freelancers just starting out

- What it does: Wave provides unlimited invoicing and accounting features at no monthly subscription cost. It combines bookkeeping, expense tracking, and client billing in one free platform.

- Who it's for: Freelancers who need professional invoicing without paying monthly fees.

The first thing I noticed about Wave was that the free plan includes everything most freelancers need. I created invoices, tracked expenses, connected bank accounts, and reviewed profit and loss reports without hitting any feature walls or invoice limits.

Wave's free Starter plan covers unlimited invoicing, estimates, bills, and bookkeeping records, although there are transaction fees. The mobile app lets you invoice on the go, and the dashboard consolidates cash flow and customer data in one place.

The platform works well for straightforward invoicing and basic accounting. It doesn't include project management or client collaboration tools, so it fits freelancers who just need clean billing paired with simple bookkeeping.

Key features

- Unlimited invoicing: Send as many invoices as needed to unlimited clients at no cost.

- Accounting features: Track income, expenses, and generate financial reports.

- Bank connections: Link accounts for automatic transaction imports.

Pros

- No monthly fees for core invoicing and accounting features.

- Clean interface that's easy to navigate.

- Solid financial reporting for tax preparation.

Cons

- Limited automation on the free plan.

- No built-in project management or time tracking.

Pricing

Wave is free for unlimited invoicing, with payment processing fees of 2.9% + $0.60 per credit card transaction (3.4% + $0.60 for Amex) and 1% for ACH transfers. The Pro plan costs $190/year and includes discounted processing fees and additional automation.

Bottom line

Wave removes the barrier of monthly subscription costs while still providing professional invoicing and complete accounting features. If you need time tracking built directly into your invoicing workflow, Harvest connects billable hours to invoices more tightly.

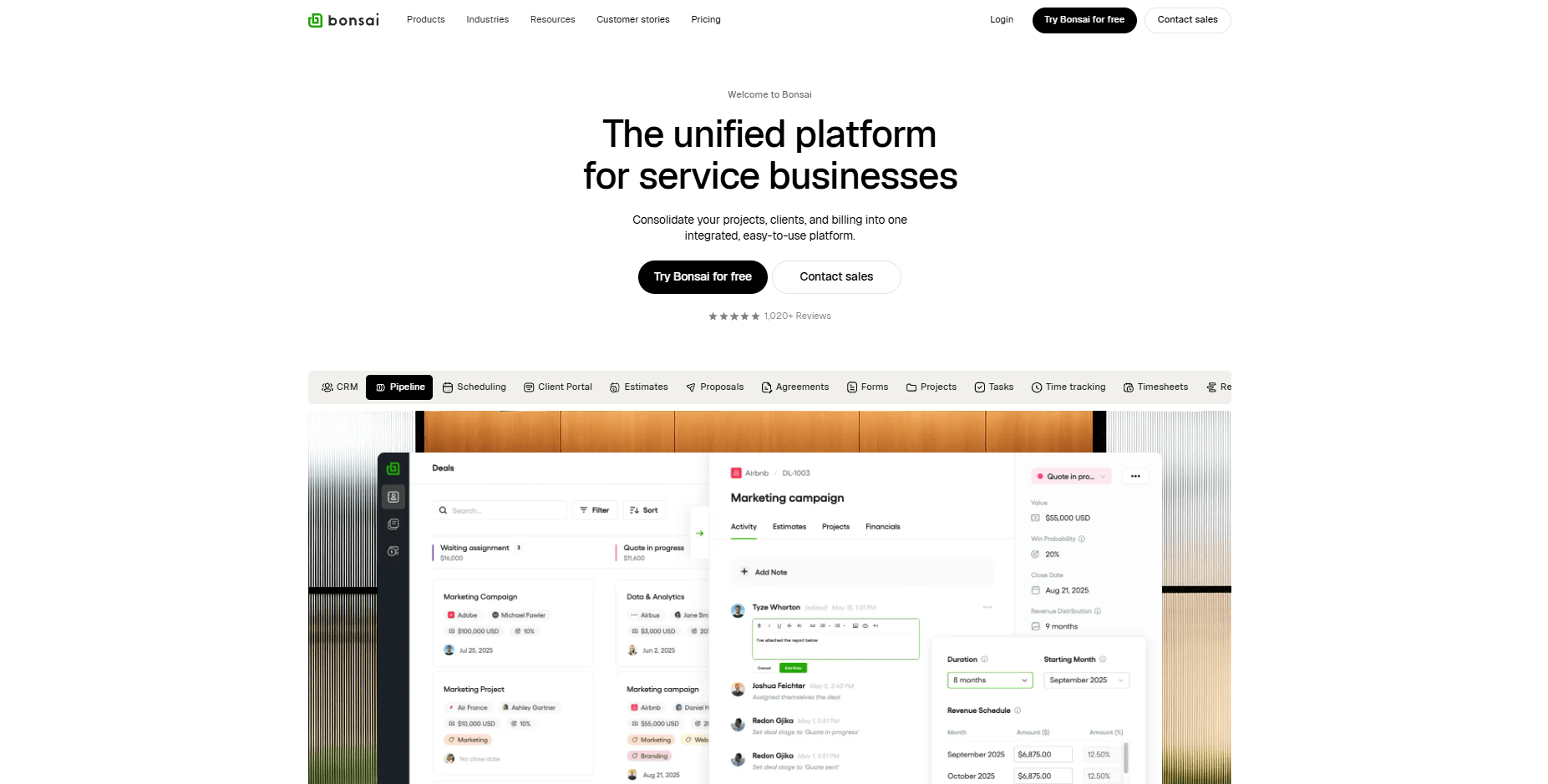

4. Bonsai: Best for freelancers managing proposals and contracts

- What it does: Bonsai is a business management platform that combines proposals, contracts, invoicing, and light automation in one workspace. It helps freelancers and small agencies organize onboarding tasks from the first proposal to the first invoice.

- Who it's for: Independent contractors and small teams who want simple tools to manage client onboarding, billing, and workflow tracking.

Bonsai handles the complete client journey from proposal to payment in a single workspace. I built a basic onboarding workflow that linked proposal templates to contracts and invoices in a few minutes. The setup was straightforward, and the automation handled reminders automatically once projects began.

Smaller teams will likely appreciate that Bonsai includes ready-to-use templates for proposals and contracts. I noticed its customization options were limited. You can adjust branding and fields, but multi-user permissions are minimal, which could slow larger teams as they grow.

Overall, it's a strong entry point for agencies formalizing their client onboarding process for the first time.

Key features

- Prebuilt templates: Ready-to-use formats for proposals, contracts, and invoices.

- Automated reminders: Scheduled notifications for payments and project deadlines.

- Basic CRM: Tracks client status and onboarding progress.

Pros

- Fast setup with minimal learning curve.

- Built-in templates for proposals and contracts.

- Affordable pricing for freelancers and new agencies.

Cons

- Limited customization for branding and workflows.

- Costs can add up with extra team members.

Pricing

Bonsai starts at $9 per user per month, which includes unlimited clients and projects. Payment processing fees are 2.9% + $0.30 per credit card transaction and 1% per ACH transfer (with a $1 minimum).

Bottom line

Bonsai connects proposals, contracts, and invoices in one workflow, which reduces the admin work of moving clients from inquiry to payment. If you need stronger client collaboration after the contract is signed, HoneyBook automates more of the ongoing client relationship.

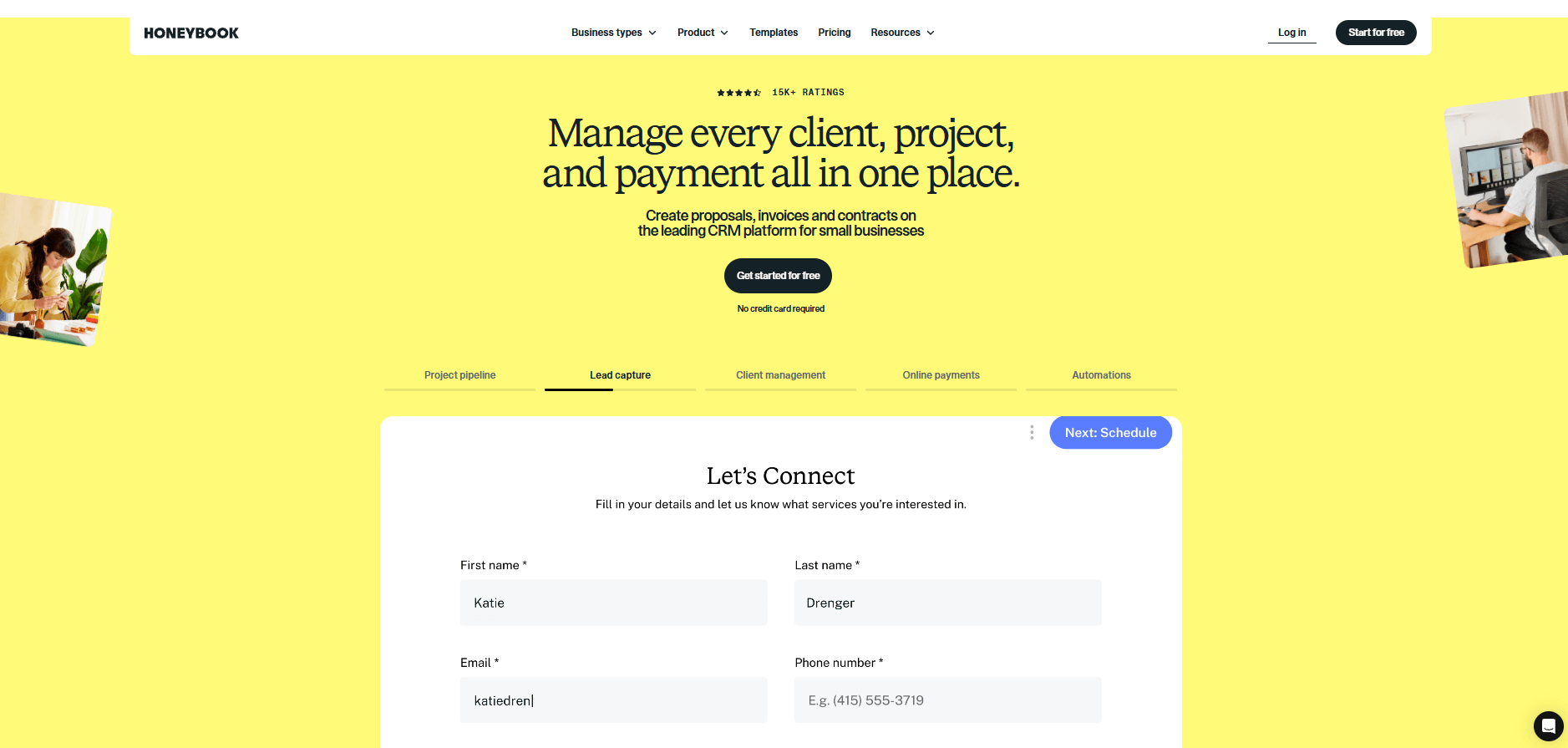

5. HoneyBook: Best for creatives handling project-based work

- What it does: HoneyBook helps small businesses manage proposals, contracts, payments, and client communication in one platform. It simplifies the booking and onboarding experience from first inquiry to final invoice.

- Who it's for: Creative professionals, event planners, and small agencies handling a steady flow of client projects.

HoneyBook manages onboarding from the first inquiry to the final invoice without adding unnecessary steps. I built a client flow using templates for proposals, contracts, and automated reminders tied to project milestones. The automations triggered invoices and welcome messages reliably, helping keep communication consistent.

The client portal was clear and easy to navigate, though customization beyond templates is limited. I found that setup takes only a few minutes, which helps small creative teams focus on projects instead of admin.

HoneyBook supports quick, organized onboarding for creatives, but larger agencies may need stronger reporting and deeper workflow flexibility than what the platform provides today.

Key features

- Automated workflows: Triggers contracts and invoices based on project milestones.

- Client portal: Lets clients view updates, files, and payment status.

- Built-in scheduling: Coordinates meetings and reminders automatically.

Pros

- Great for creatives who manage client projects end-to-end.

- Easy to automate client welcome sequences.

- Affordable entry-level pricing.

Cons

- Limited customization beyond templates.

- Reporting features are minimal.

Pricing

HoneyBook offers a 30-day free trial and starts at $29 per month. Its payment processing fees are 2.9% + 25¢ for card payments and 1.5% for ACH transfers.

Bottom line

HoneyBook automates the client journey from inquiry to payment with minimal setup, which saves time for creative professionals managing multiple projects. If you need invoicing tied to detailed time tracking for hourly work, Harvest connects billable hours directly to invoice generation.

6. Quaderno: Best for freelancers with international clients or tax compliance needs

- What it does: Quaderno is an invoicing platform that automatically calculates and applies sales tax based on client location. It handles tax compliance for freelancers working across different countries and states.

- Who it's for: Freelancers and service businesses that invoice international clients or need automated tax calculations.

One thing that stood out about Quaderno was how it handles tax calculations automatically based on where your client is located. I tested invoices for clients in different US states and European countries, and Quaderno applied the correct tax rates without needing manual lookups or adjustments.

The platform integrates with Stripe and PayPal for payment processing, so you're using familiar gateways rather than learning a new payment system. The interface focuses on invoicing and tax compliance rather than broader project management.

Quaderno works well for freelancers who spend too much time figuring out which tax rates apply to which clients. It reduces the compliance burden but doesn't offer features like time tracking or client portals.

Key features

- Automatic tax calculations: Applies correct sales tax based on client location across countries and states.

- Payment gateway integration: Works with Stripe and PayPal for processing.

- Compliance reports: Generates tax reports for filing requirements.

Pros

- Removes the manual work of calculating international taxes.

- Clean interface focused on invoicing.

- Supports multi-currency transactions.

Cons

- No time tracking or project management features.

- Monthly pricing with no free tier.

Pricing

Quaderno starts at $29 per month, billed monthly. Payment processing fees depend on your chosen gateway (typically Stripe at 2.9% + 30¢ or PayPal at similar rates).

Bottom line

Quaderno solves the specific problem of tax compliance for freelancers working across borders, which saves hours of research and reduces filing errors. If you need a completely free invoicing option with basic accounting features, Wave offers unlimited invoicing at no monthly cost.

7. Zoho Invoice: Best for small teams needing a free tool

- What it does: Zoho Invoice is a free invoicing platform that handles international transactions and integrates with multiple payment gateways. It supports multi-currency invoicing and payment processing across different countries.

- Who it's for: Small teams and freelancers who invoice international clients and need multi-currency capabilities.

Zoho Invoice caught my attention because it's completely free with no subscription fees. I created invoices in different currencies and connected multiple payment gateways, including Stripe, PayPal, and Authorize.net, without any subscription costs.

The platform includes basic automation like payment reminders and recurring invoices. I noticed the interface has more options than simpler tools, which means a slightly longer learning curve. The free plan includes "Powered by Zoho Invoice" branding on invoices.

Zoho works well for freelancers who need professional invoicing across currencies without monthly costs, though teams wanting deeper client collaboration will need to look elsewhere.

Key features

- Multi-currency support: Create and send invoices in different currencies for international clients.

- Multiple payment gateways: Integrates with Stripe, PayPal, Authorize.net, and others.

- Client portal: Lets clients view invoice history and make payments.

Pros

- Free

- Handles international currencies and payment gateways.

- Strong security with PCI-DSS compliance and two-factor authentication.

Cons

- Interface can feel cluttered compared to simpler tools.

- Free plan includes Zoho branding on invoices.

Pricing

Zoho Invoice is completely free with no subscription fees as of early 2026, with no subscription fees or limits on clients or invoices. Payment processing fees depend on your chosen gateway (typically 2.9% + 30¢ via Stripe or PayPal). If you need more advanced features, Zoho offers a separate paid product called Zoho Billing.

Bottom line

Zoho Invoice stands out as a completely free platform that handles multi-currency invoicing and multiple payment gateways, which removes cost barriers for freelancers just starting with international clients. If you need tax compliance automation for cross-border invoicing, Quaderno is a better choice.

8. Square Invoices: Best for local service providers and on-the-go billing

- What it does: Square Invoices is a mobile-friendly invoicing tool that works within Square's payment ecosystem. It lets you send invoices, accept payments, and track transactions from your phone or computer.

- Who it's for: Local service providers, contractors, and freelancers who bill clients on location or need mobile invoicing.

I used the mobile app to check how Square Invoices handles on-the-go billing, and the workflow felt designed for people working in the field. I created an invoice, sent it to a test client, and tracked the payment status from my phone in under two minutes. The interface is clean and requires minimal taps to complete common tasks.

Square's strength is the integration with its full payment ecosystem. If you already use Square for in-person payments, invoices sync with your existing transaction history automatically. The Free plan charges higher online processing fees (3.3% + 30¢), while the Plus plan at $49/month reduces those to 2.9% + 30¢.

Square fits service providers who move between job sites or need to invoice immediately after completing work. It's less suited for agencies managing complex client relationships or detailed project tracking.

Key features

- Mobile invoicing: Send and track invoices directly from your smartphone.

- Payment ecosystem: Syncs with Square's point-of-sale and payment processing.

- Automated reminders: Send payment reminders to clients automatically.

Pros

- Fast mobile experience for on-location billing.

- Integrates seamlessly with Square hardware and payments.

- Free plan available with pay-per-transaction pricing.

Cons

- Higher processing fees on the Free plan compared to competitors.

- Limited features for client collaboration or project management.

Pricing

Square Invoices starts at $49 per month for the Plus plan, with online invoice processing at 2.9% + 30¢ per transaction. A Free plan is available with higher processing fees of 3.3% + 30¢ for online invoices.

Bottom line

Square Invoices excels at mobile billing for service providers who need to invoice clients immediately after completing work on location. If you need proposals and contracts alongside invoicing for client projects, Bonsai combines all three in one simple workflow.

9. Harvest: Best for time-based billing and hourly work

- What it does: Harvest connects time tracking directly to invoice generation. It helps freelancers and agencies bill clients based on tracked hours and project time.

- Who it's for: Freelancers and consultants who bill by the hour and need accurate time tracking tied to invoicing.

Harvest focuses on converting tracked time into invoices, which I tested by logging hours across different projects and clients. The time entries automatically populated invoice line items with descriptions, hourly rates, and totals. I didn't need to manually calculate or transfer data between systems.

The platform shows you exactly how much time you're spending on different clients and projects through clear reporting. This helps you spot which work is profitable and which clients take more hours than expected.

The free plan includes one seat, two projects, time tracking, basic reporting, and invoicing, which covers the basics for solo freelancers testing out time-based billing. Harvest integrates with Stripe and PayPal for payment processing but doesn't charge its own fees on top of standard gateway rates.

Key features

- Time tracking: Records billable hours with project and client tags.

- Automatic invoice generation: Converts tracked time directly into invoice line items.

- Reporting: Shows time allocation, project profitability, and team utilization.

Pros

- Tight integration between time tracking and invoicing.

- Clean interface with straightforward time entry.

- No additional fees beyond payment gateway rates.

Cons

- Limited features for flat-rate or milestone-based billing.

- Basic project management compared to specialized tools.

Pricing

Harvest starts at $9 per seat per month. Payment processing fees depend on your chosen gateway, typically 2.9% + 30¢ via Stripe or PayPal, with no additional Harvest fees.

Bottom line

Harvest eliminates the manual work of calculating billable hours and transferring them to invoices, which saves time for anyone billing by the hour. If you need client portals where clients can view invoices alongside contracts and files, Assembly provides a more complete client-facing experience.

10. Invoice Ninja: Best for tech-savvy freelancers wanting customization

- What it does: Invoice Ninja is an open-source invoicing platform that offers extensive customization options. It lets you modify templates, workflows, and branding to match your specific needs.

- Who it's for: Freelancers and agencies who want control over their invoicing system and don't mind technical configuration.

I thought the setup for Invoice Ninja would be more complex given its open-source nature, but the hosted version made invoicing pretty straightforward. The real value shows up when you want to customize beyond standard templates. I adjusted invoice designs, modified automated workflows, and connected to different payment gateways without hitting artificial restrictions.

The free plan supports up to 100 clients, which covers most freelancers. Invoice Ninja doesn't add its own fees on top of payment processing, so you only pay whatever your chosen gateway charges. The interface offers more options than simpler tools, which means some clicking around to find specific settings.

Invoice Ninja fits freelancers who want flexibility and don't mind spending time configuring their invoicing system exactly how they want it.

Key features

- Open-source platform: Full access to customize code, templates, and workflows.

- Multiple payment gateways: Integrates with 40+ payment processors.

- White-label options: Remove Invoice Ninja branding on paid plans.

Pros

- Extensive customization for branding and workflows.

- Free plan supports up to 100 clients.

- No platform fees beyond payment gateway charges.

Cons

- More configuration options mean a steeper learning curve.

- Interface can feel technical compared to simpler tools.

Pricing

Paid plans starting at $10 per month for unlimited clients and additional features. Payment processing fees depend on your chosen gateway, with no additional Invoice Ninja fees.

Bottom line

Invoice Ninja gives you control over every aspect of your invoicing system through customization and open-source flexibility. If you prefer a simpler interface with less configuration and still want free invoicing, Wave offers unlimited invoicing with built-in accounting features.

11. Stripe Invoicing: Best for freelancers with recurring revenue models

- What it does: Stripe Invoicing provides built-in subscription billing and automated payment collection. It handles recurring invoices, payment retries, and revenue recognition for subscription-based businesses.

- Who it's for: Freelancers and service businesses with recurring monthly revenue or retainer clients.

The standout feature of Stripe Invoicing is how it handles subscription billing automatically. I set up a recurring invoice with automatic payment collection, and Stripe managed the billing cycle, payment retries on failed charges, and customer notifications without manual intervention.

The platform charges per transaction rather than monthly subscriptions, which means costs scale directly with your invoicing volume. This pricing model works if you send invoices occasionally or inconsistently, but frequent billing can make it more expensive than flat-rate platforms.

Stripe works well for freelancers with predictable monthly revenue from retainer clients. It's less suited for one-off project billing or freelancers who don't need subscription management.

Key features

- Subscription billing: Automates recurring invoices and payment collection.

- Smart retries: Attempts to collect failed payments automatically.

- Revenue recognition: Tracks recurring revenue and customer lifetime value.

Pros

- Strong automation for subscription-based billing.

- Built into Stripe's payment infrastructure.

- Detailed revenue analytics for recurring income.

Cons

- Higher total fees (0.4% invoice fee plus processing fees).

- More complex than needed for simple one-time invoicing.

Pricing

Stripe Invoicing starts at 0.4% per paid invoice. These fees stack on top of standard Stripe processing fees of 2.9% + 30¢ per transaction, totaling roughly 3.3% + 30¢ per invoice. Volume discounts are available for high-volume businesses.

Bottom line

Stripe Invoicing automates subscription billing and payment collection for freelancers with recurring revenue, which reduces manual work for retainer-based businesses. If you need free invoicing for occasional client work without subscription complexity, Zoho Invoice offers unlimited invoices for up to 5 clients at no cost.

How I tested the best invoice software for freelancers

I spent several weeks setting up accounts, creating test invoices, and processing payments through each platform to see how they handle the full billing cycle. My goal was to find which tools actually save time for freelancers and which ones add unnecessary complexity.

I approached every platform like a freelancer managing multiple clients with different payment needs. This meant testing recurring invoices, one-time bills, late payment reminders, and how clearly clients could view their payment history.

Here's what I focused on:

- Invoice creation speed: I timed how long it took to create a professional invoice from scratch, including customizing branding and adding line items. Tools that required more than five clicks to send a basic invoice lost points.

- Payment processing transparency: I checked what fees each platform charges and whether those costs were clearly disclosed upfront. Some tools bury platform fees in fine print, which matters when you're calculating project profitability.

- Client experience: I viewed every invoice from the client's perspective to see what they'd actually receive. Clunky payment portals or confusing instructions can create problems that delay payments.

- Automation capabilities: I set up recurring invoices and payment reminders to test whether automation actually worked reliably. Several platforms claimed automation but required manual intervention.

- Mobile functionality: I tested each platform's mobile app or mobile web experience because freelancers often need to invoice clients immediately after completing work on location.

- Integration depth: I connected each tool to payment processors, accounting software, and project management platforms to see how well data synced across systems.

Which invoice software should you choose?

Your choice of invoicing software depends on whether you want to pay monthly for features or stick with free tools that charge only processing fees. Choose:

- Assembly if you want invoicing built into a client portal where contracts, payments, and communication stay connected in one branded space.

- FreshBooks if you need invoicing tied directly to accounting features like expense tracking and financial reporting for tax preparation.

- Wave if you're starting out and want completely free invoicing with built-in accounting features and no monthly subscription costs.

- Bonsai if you need templates that connect proposals, contracts, and invoices in one workflow for client onboarding.

- HoneyBook if you're a creative professional who wants to automate client workflows from inquiry through final payment.

- Quaderno if you invoice international clients and need automatic tax calculations that handle compliance across different countries and states.

- Zoho Invoice if you want free multi-currency invoicing with support for multiple payment gateways.

- Square Invoices if you work on location and need mobile-friendly invoicing that syncs with Square's payment ecosystem.

- Harvest if you bill by the hour and need time tracking that converts directly into invoice line items.

- Invoice Ninja if you want an open-source platform with extensive customization options and no platform fees beyond payment processing.

- Stripe Invoicing if you have recurring revenue from retainer clients and need automated subscription billing with smart payment retries.

My final verdict

I found that free tools like Wave, Zoho Invoice, and Invoice Ninja work well when you're just starting out and need basic invoicing without monthly costs. They cover the fundamentals but lack client collaboration features and advanced workflows.

FreshBooks and HoneyBook connect invoicing to accounting or full client workflows. Harvest and Bonsai link invoices to time tracking or proposals. Quaderno focuses specifically on tax compliance for international work.

Assembly treats invoicing as one piece of the client relationship rather than an isolated transaction. You get a branded portal where invoices appear alongside contracts, files, and communication history. This keeps everything connected from the first proposal through final payment.

I think this structure works better for service businesses managing ongoing relationships because it eliminates the trouble of switching between separate tools for billing, contracts, and client updates.

Want invoicing built into your client portal? Try Assembly

Many of the best invoice software options for freelancers focus only on sending bills and tracking payments. Free tools cover the basics but often lack professional branding, client collaboration features, or the ability to scale as your business grows. You still need separate tools for contracts, client communication, and file sharing, which makes getting paid more difficult.

Assembly is a branded client portal software tool that gives you one place to handle invoicing, contracts, communication, and file sharing. It connects billing to the full client relationship, so invoices appear alongside everything else your clients need in one professional space.

Here’s what you can do with Assembly:

- Send invoices through a branded client portal: Our Billing app creates invoices that appear in your client's portal alongside contracts and files, connecting payment requests to the full relationship instead of isolated email threads.

- Accept payments with full context: Clients view their complete invoice history, payment methods, and outstanding balances in one organized space. You can set up recurring invoices, one-time bills, and subscription pricing without switching tools.

- Prep for billing conversations: The AI Assistant surfaces past payment patterns, notes, and invoice history, helping you address billing questions during meetings with full context already in hand.

- Automate payment workflows: Set up automated payment reminders that used to take manual work. The Assistant handles billing busywork so you can focus on delivering client work.

- Expand invoicing functionality: Install apps from the Marketplace or commission custom builds through the Experts Marketplace to add features like advanced reporting, custom payment flows, or integrations specific to your billing needs.

Ready to stop juggling separate tools for invoicing, contracts, and client communication? Start your free Assembly trial today.

Frequently asked questions

What are the biggest benefits of using invoice software for freelancers?

The biggest benefits of using invoice software for freelancers are faster payment collection through automated reminders, clear tracking of paid and overdue invoices, and branded invoices that improve client perception. You spend less time on manual invoice creation and data entry. Most platforms generate financial reports that simplify tax preparation and show revenue patterns across clients.

Are there free invoice software options for freelancers?

Yes. Wave, Zoho Invoice, Invoice Ninja, Harvest, and Stripe Invoicing all offer free plans. Wave and Zoho Invoice are completely free with no monthly fees. Wave provides unlimited invoicing and accounting, while Zoho Invoice supports multi-currency transactions and over a dozen payment gateways. Invoice Ninja, Harvest, and Stripe Invoicing have free tiers with feature limits. All apply standard processing fees.

How does invoice software improve payment speed for freelancers?

Invoice software sends automated payment reminders to clients, accepts online payments directly through invoices, and lets clients pay with credit cards or bank transfers in a few clicks. You eliminate the delays of mailing checks or coordinating bank transfers manually. Clear payment portals also reduce confusion about where to send payment, which cuts down on the back-and-forth messages.

Your clients deserve better.

Try for free for 14 days, no credit card required.