13 Best client portals for accountants in 2025: Features & pricing

Build the perfect client management system

Assembly helps agencies centralize clients, projects, and communication without the chaos. Get started free.

4.9 rating

- 13 Best client portals for accountants: At a glance

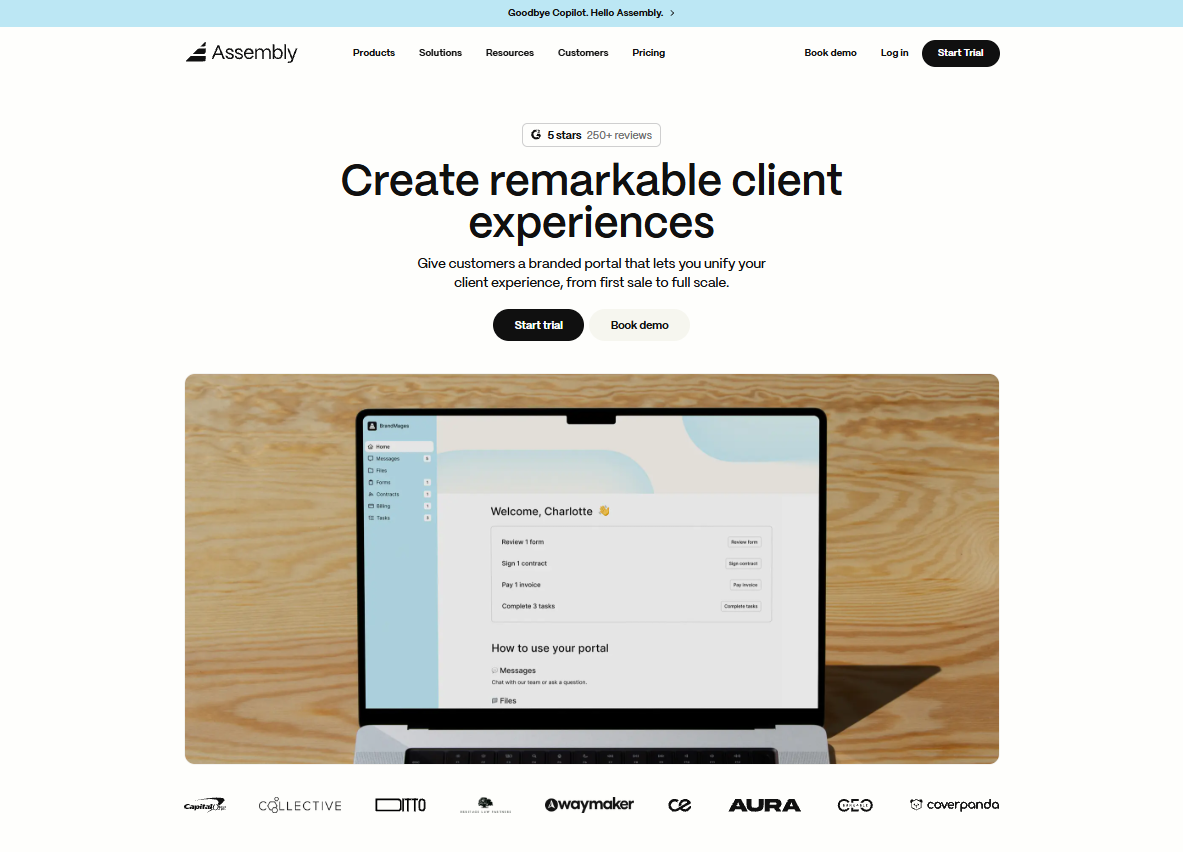

- 1. Assembly: Best for branded client experience

- 2. Canopy: Best for accounting workflow management

- 3. TaxDome: Best for tax and bookkeeping teams

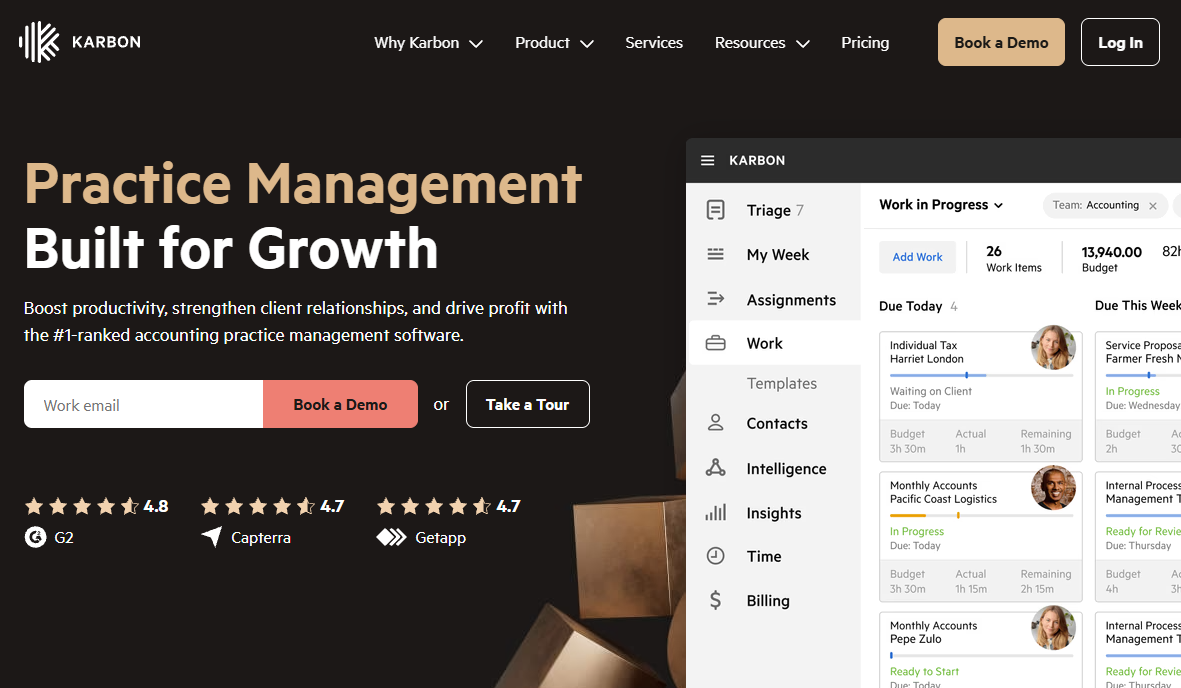

- 4. Karbon: Best for high-volume client coordination

- 5. SmartVault: Best for secure document storage

- 6. Liscio: Best for mobile client communication

- 7. FuseBase: Best for client collaboration

- 8. Financial Cents: Best for workflow and client tracking

- 9. Client Hub: Best for QuickBooks and Xero users

- 10. Moxo: Best for high-touch client service

- 11. Jetpack Workflow: Best for recurring job tracking

- 12. HoneyBook: Best for proposals and payments

- 13. Bonsai: Best for solo accountants

- How I tested client portals for accountants

- Which client portal for accountants should you choose?

- My final verdict

- Build a more connected client experience for your accounting firm with Assembly

- Frequently asked questions

After testing dozens of platforms across accounting and client service workflows, these are the 13 best client portals for accountants in 2025.

13 Best client portals for accountants: At a glance

Modern client portals for accountants bring billing, file sharing, and communication into one organized system. Some focus on automation, while others focus on branding or collaboration. Here’s how they compare in 2025:

| Alternative | Best For | Starting Price (Billed Annually) | Key Advantage vs TaxDome |

|---|---|---|---|

| Assembly | Client portals and CRM in one platform | $39/month | Combines billing, forms, and client messaging in one place |

| Canopy | Modular accounting workflows | $45/user/month for the Starter small firms plan | Lets firms pay only for the modules they need |

| Karbon | Email-based workflow management | $59/user/month | Adds structure for collaboration and task tracking |

| Financial Cents | Simple automation for small firms | $19/month | Handles recurring jobs without complex setup |

| Uku | Task tracking and billing in one view | $38/user/month | Links time tracking directly to invoices |

| SuiteDash | Custom portals with advanced control | $180/year | Provides white-label portals with flexible permissions |

1. Assembly: Best for branded client experience

- What it does: Assembly is a client portal and CRM that combines messaging, billing, and contracts in one organized workspace. Accounting teams use it to keep client communication and payments connected.

- Who it’s for: Accounting and service-based firms that want a branded client experience without juggling multiple tools or email threads.

We built Assembly to help accounting teams manage client work after onboarding without switching between tools for billing, documents, and communication. Everything your clients need to review, sign, or pay is in one secure portal.

When a client signs an engagement letter or approves a proposal, it links directly to their record, so renewals and past agreements are easy to track. You’ll know where each client stands without digging through email threads.

Our billing system handles both recurring and one-time payments, making it easier to manage retainers and seasonal clients. Files, messages, and invoices stay connected to the right account in one workspace.

Assembly Assistant is our AI feature that can help your team get context before client calls by surfacing notes, files, and history. It also drafts follow-ups so you can focus on advising instead of prep.

Each portal carries your branding and connects with tools like Airtable, Calendly, and ClickUp. You can also automate updates and reminders through Zapier or Make, keeping every client touchpoint organized in one workflow.

Key features

- Branded client portal: One login for clients to view contracts, payments, and updates

- Billing and contracts: Built-in invoicing, e-signatures, and payment collection

- AI Assistant: Surfaces notes, files, and client history before calls

- Integrations: Works with Airtable, ClickUp, Calendly, Zapier, and Make

- Permissions control: Adjust access for clients and team members

Pros

- Branded, professional experience that keeps clients organized

- Combines billing, communication, and contracts in one place

- Connects easily with popular workflow tools

Cons

- Higher starting price than lightweight CRMs

- More features than solo accountants may need

Pricing

Assembly starts at $39 per month for the Starter plan.

Bottom line

Assembly helps accountants centralize billing, contracts, and communication in one portal so every client interaction stays organized. It’s good if you want a polished client experience after onboarding, but if you focus mainly on tax prep or document delivery, you may prefer a tool like SmartVault or Financial Cents.

2. Canopy: Best for accounting workflow management

- What it does: Canopy is a cloud platform that combines client management, document storage, billing, and task tracking in one workspace for accounting firms. It keeps all client work and communication organized and easy to access.

- Who it’s for: Mid-size accounting firms that need workflow visibility and client collaboration in one organized platform.

When I tested Canopy, I wanted to see how it supports firms that manage dozens of clients at once. The system connects every client record with its related tasks, files, and messages, which helps eliminate the usual email sprawl.

I liked how overdue work appears in a single workflow view, giving managers a quick sense of where attention is needed.

The billing and time-tracking features took some setup, but worked smoothly once configured. I noticed that clients also respond faster through Canopy’s portal since file uploads and payments live in one place.

It’s a structured tool that rewards consistency, but smaller firms may find the setup heavier than they need.

Key features

- Workflow management: Create and assign recurring tasks with deadlines

- Client portal: Securely upload files, sign forms, and pay invoices

- Billing tools: Track time and send invoices directly

Pros

- Combines workflow and collaboration in one system

- Built-in portal reduces client follow-ups

- Strong accounting and cloud integrations

Cons

- Some automation features require higher-tier plans

- Initial setup takes time for new teams

Pricing

Canopy starts at $45 per user per month for small firm plans.

Bottom line

Canopy helps accounting firms organize jobs, documents, and client collaboration under one platform. It’s dependable for firms that need structure across departments. However, smaller practices focused mostly on tax filing or document exchange may find SmartVault or Liscio easier to manage.

3. TaxDome: Best for tax and bookkeeping teams

- What it does: TaxDome is an all-in-one platform for tax and accounting firms. It combines client portals, document storage, e-signatures, messaging, and workflow automation in one hub.

- Who it’s for: Accounting and bookkeeping teams that manage recurring tax clients and need to centralize communication and documents.

I tested TaxDome to see how its automation performs under the pressure of repeat tax and bookkeeping cycles. Once workflows are built, automation takes over cleanly. Pipelines trigger new steps when clients upload files or sign engagement letters, which helps firms move jobs forward without manual follow-ups.

The client portal gives a full view of progress for each client, including messages, documents, and invoices. It’s structured and efficient once you learn the layout, but the first setup can feel dense for new users.

After testing across a few mock firms, I found TaxDome scales well for busy seasons. Once automation is tuned, it runs predictably and helps teams manage larger client volumes without losing track of jobs.

Key features

- Client portal: Uploads, e-signatures, and payments in one place

- Automation: Trigger reminders and follow-ups automatically

- Pipeline tracking: Visualize job stages and client progress

Pros

- Centralized system for tax clients

- Integrated automation and billing

- Secure file sharing and e-signatures

Cons

- Interface takes time to learn

- Automation setup can be complex initially

Pricing

TaxDome starts at $800 per year for a one-year commitment, with discounts for multi-year plans.

Bottom line

TaxDome helps firms manage repeat tax clients through automation and a unified client portal. It’s practical for teams that value built-in billing and document management. However, if you’re focused on year-round advisory work, you may prefer Canopy or Assembly.

4. Karbon: Best for high-volume client coordination

- What it does: Karbon is a work management and collaboration platform for accounting teams. It combines email, tasks, and client communication in one shared workspace.

- Who it’s for: Firms that manage large client lists or recurring work and need visibility across deadlines and workloads.

I tried Karbon across different firm setups to understand how it supports recurring accounting work at scale. You can turn emails into tasks, assign them, and track completion in one shared view. It builds a full audit trail for every client, which helps teams manage reconciliations, payroll, and tax prep with fewer gaps.

What stood out while I was reviewing Karbon was how predictable the workflows became once automation kicked in. Everyone can see what’s in progress and what’s waiting on the client, so follow-ups happen naturally. Templates handle recurring jobs and reminders, freeing up time for higher-value work.

Karbon also integrates with QuickBooks, Ignition, and Xero, creating one organized hub for communication, active jobs, and due dates across the firm.

Key features

- Shared inbox: Turn emails into tasks or assign them to teammates

- Workflow automation: Build recurring job templates for repeat processes

- Client requests: Auto-send reminders when clients miss deadlines

Pros

- Strong visibility across client jobs and workloads

- Reliable automation for recurring accounting work

- Integrates with major accounting and workflow tools

Cons

- Pricing increases quickly with team size

- Setup takes time for smaller firms

Pricing

Karbon pricing starts at $59 per user per month for the Team plan.

Bottom line

Karbon helps accounting firms organize recurring work, automate client reminders, and keep teams aligned. It’s structured for firms that handle high-volume clients or shared workloads, but firms that need a branded client portal or lighter collaboration features may prefer Assembly or Liscio.

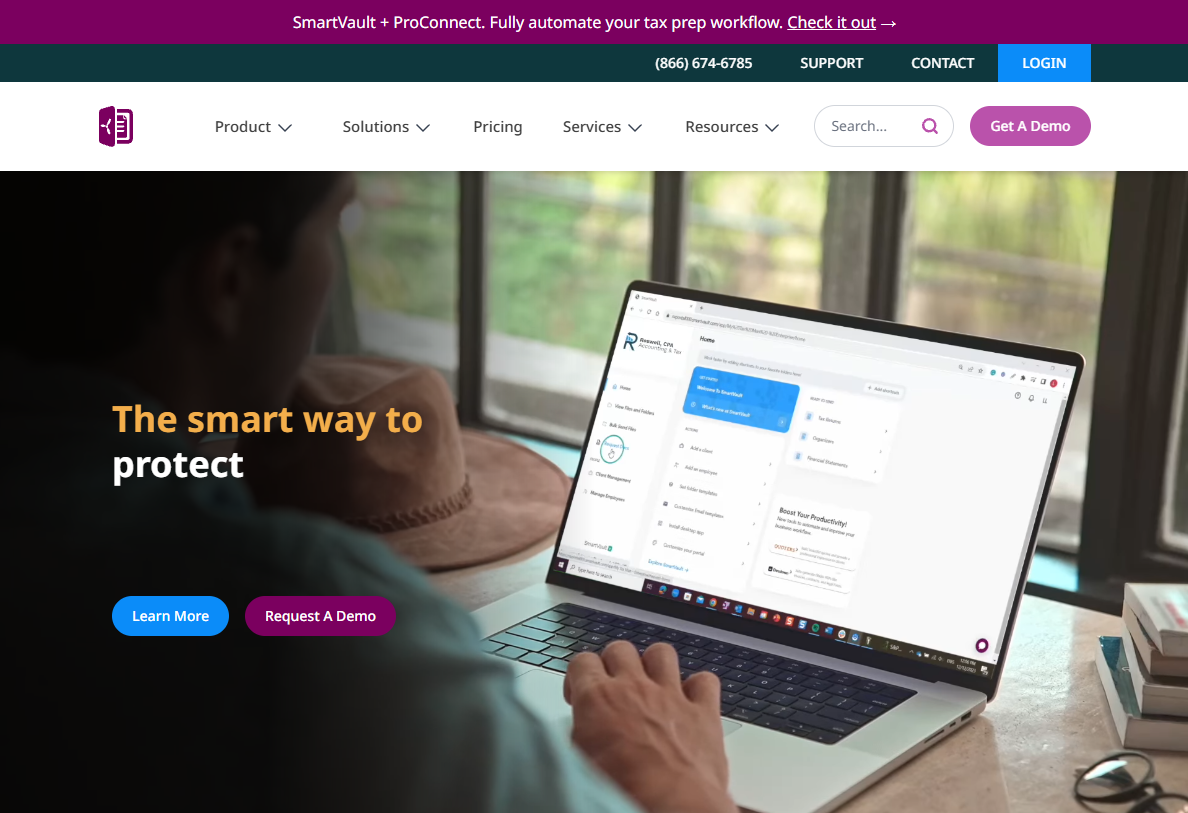

5. SmartVault: Best for secure document storage

- What it does: SmartVault is a cloud-based document management system that gives accountants a secure way to store, share, and request files. It centralizes folders and keeps every record compliant.

- Who it’s for: Accounting and bookkeeping firms that handle sensitive financial data and need secure, audit-ready storage.

My goal for testing SmartVault was to see how it supports document-heavy accounting work. Uploading tax files, receipts, and reports was smooth, and file organization stayed consistent even with large folders. Its reliability and compliance features stood out early, especially when handling sensitive client data.

Permission controls made it easy to set access levels and protect private records. The QuickBooks integration also worked well, letting me attach supporting documents directly to transactions. That saved time during reconciliation and review cycles, particularly for firms juggling multiple client books.

Upload speeds stayed consistent, and folder templates kept things organized across clients. The downside is that the design is dated compared to newer tools.

Key features

- Secure file sharing: Encryption and compliance controls with document management and e-signatures

- QuickBooks integration: Attach files directly to transactions

- E-signatures: Collect signatures through DocuSign

Pros

- Reliable and secure storage for financial records

- Integrates with core accounting tools

- Organized templates for client folders

Cons

- Interface feels dated compared to newer tools

- Lacks messaging or workflow features

Pricing

SmartVault starts at $50 per user per month, with a three-user minimum.

Bottom line

SmartVault gives accountants secure, compliant document storage in one place. It’s a dependable option for firms managing sensitive client data, but if you’re looking for more collaboration features, you might prefer Canopy or Liscio.

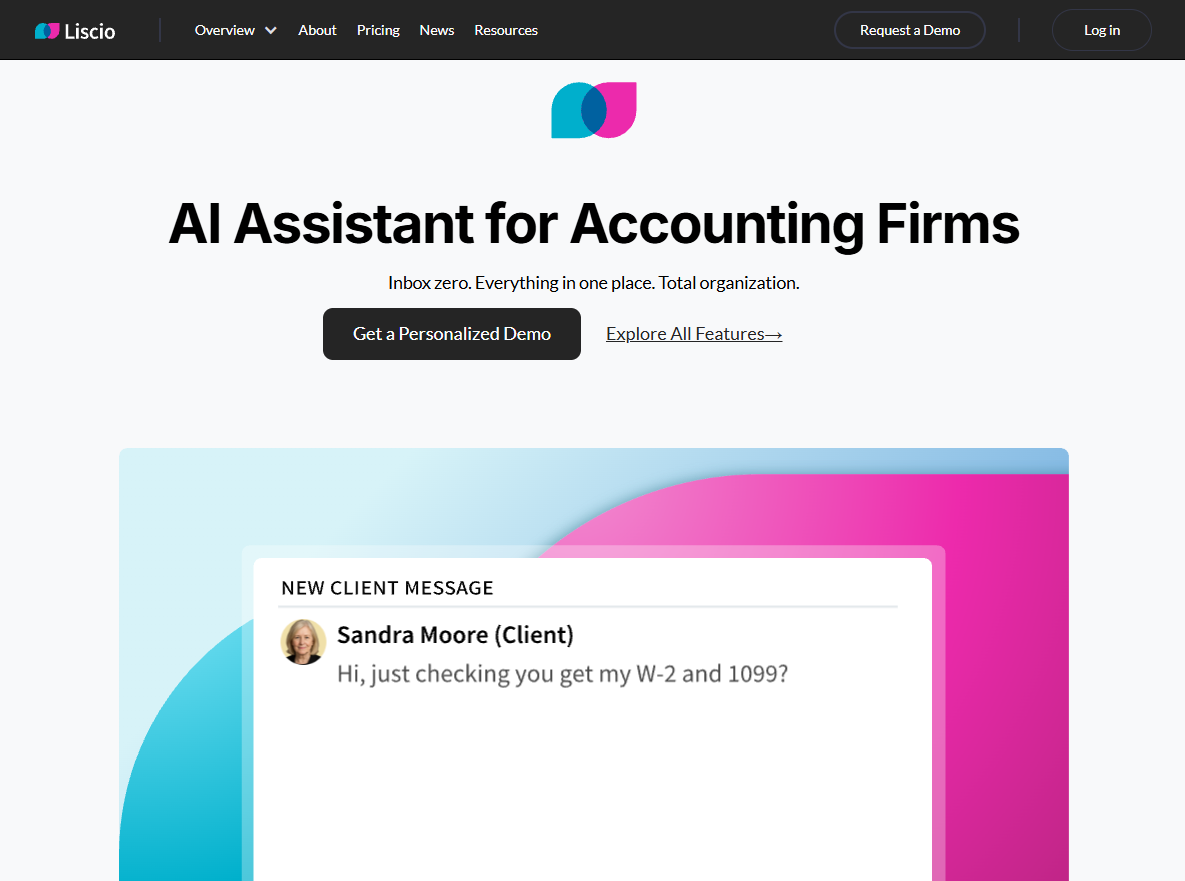

6. Liscio: Best for mobile client communication

- What it does: Liscio is a secure communication and document-sharing app built for accountants. It combines messaging, file uploads, and task reminders in a single, mobile-friendly platform.

- Who it’s for: Accounting firms that prioritize client communication and want a simple, secure alternative to email.

Liscio stood out during my testing for its focus on clarity and convenience. I replaced traditional email threads with its messaging system and quickly noticed how organized communication became.

Clients could upload forms, statements, and receipts from their phones, and everything appeared in one clean thread.

Notifications and reminders worked well to prompt clients to send missing information. I liked that messages, uploads, and signatures stay connected to the right client instead of getting buried in inboxes. The app also keeps things simple enough for non-technical clients to use confidently.

Liscio focuses on communication rather than workflow automation. For firms that want fast, secure client communication without complexity, Liscio handles that job effectively.

Key features

- Two-way messaging: Secure chat between clients and staff

- Mobile app: Upload files and receive notifications on the go

- Reminders: Nudge clients automatically for missing documents

Pros

- Great for fast, secure client messaging

- Strong mobile functionality

- Integrates with existing document tools

Cons

- Limited internal workflow tools

- Pricing can add up for large firms

Pricing

Liscio starts at $49 per user per month, whether you’re going for the Advisory & Bookkeeping plans or the Tax Professional plans.

Bottom line

Liscio helps accountants manage real-time communication without using email. It’s effective for firms that want secure, mobile-friendly exchanges. However, firms that need structured workflows may prefer Canopy or Financial Cents.

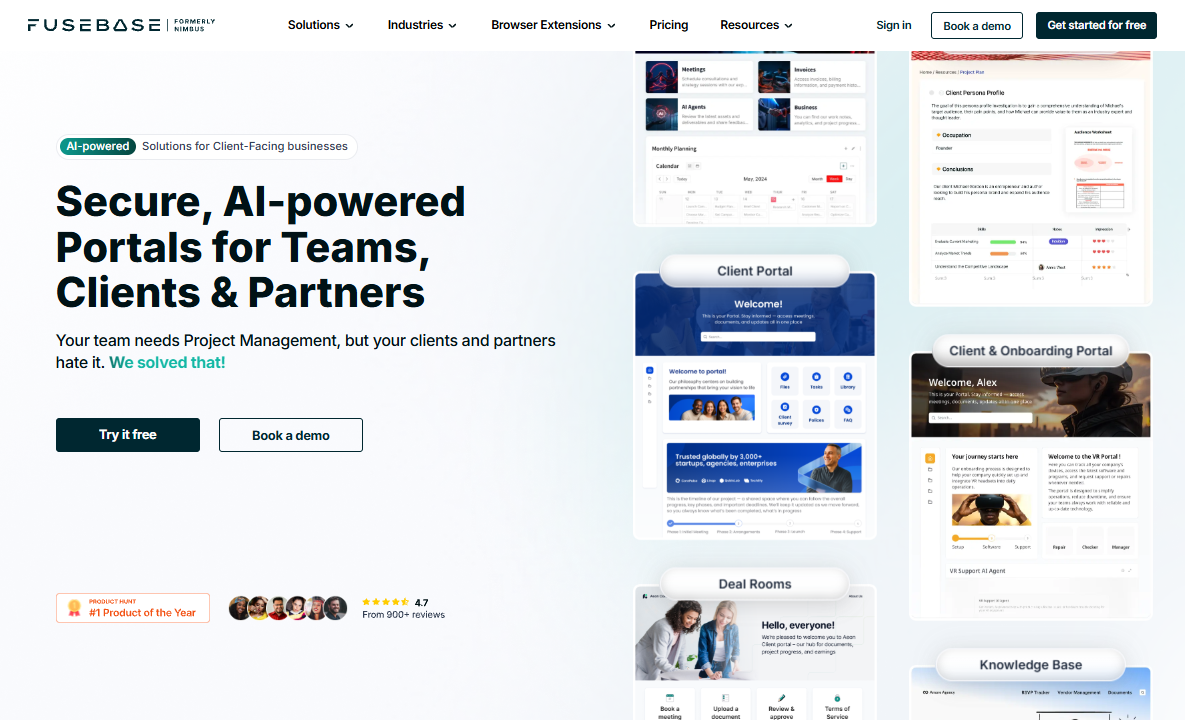

7. FuseBase: Best for client collaboration

- What it does: FuseBase is a collaboration and knowledge-sharing tool that lets firms create branded client portals. It combines notes, file sharing, and project tracking in one customizable workspace.

- Who it’s for: Accounting and consulting firms that share deliverables or reports with clients and want flexible, branded portals.

I tested FuseBase by creating branded client portals to see how flexible it could be for accountants. Each one handled deliverables, shared notes, and visual dashboards in a single, branded space. Clients could comment next to documents, which helped consolidate feedback.

The customization options are a defining feature of FuseBase, letting firms shape how each client experience looks and feels.

You can adjust layout, color, and permissions to match how you deliver financial reports or advisory materials. I liked that it supported embedded dashboards and real-time commenting, making it easy to turn static reports into conversations.

It’s not purpose-built for accounting workflows, but it adapts well for firms that value presentation.

Key features

- Custom portals: Create branded workspaces for each client

- Content sharing: Combine notes, files, and reports in one view

- Collaboration tools: Comment and edit with your team in real time

Pros

- Highly customizable and brandable portals

- Great for client-facing collaboration

- Simple pricing for small teams

Cons

- Lacks accounting-specific automations

- Limited native integrations

Pricing

FuseBase starts at $32 per month for the Solo plan.

Bottom line

FuseBase gives accountants flexibility for client collaboration, document sharing, and branded reporting. It’s good for firms that share deliverables regularly or handle advisory work. But if your priority is automation or task tracking, Canopy or Financial Cents might be a better fit.

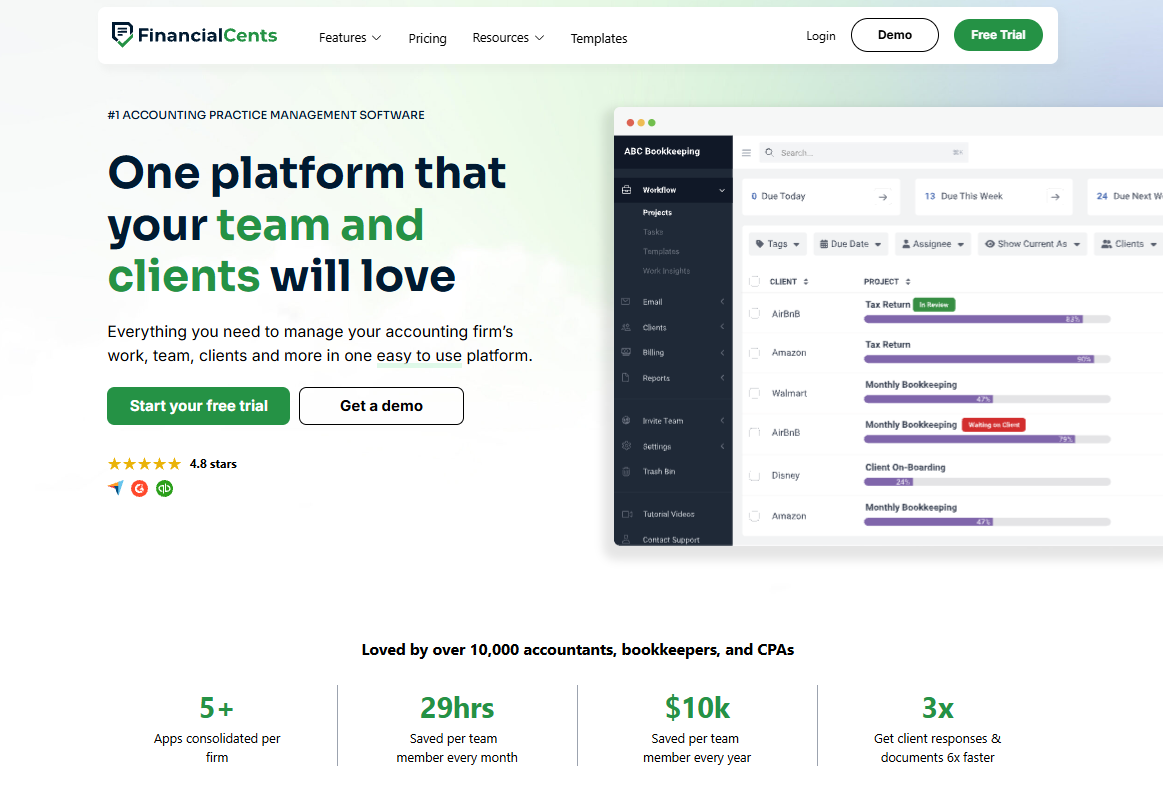

8. Financial Cents: Best for workflow and client tracking

- What it does: Financial Cents is a workflow and client management tool built for accountants. It helps firms track jobs, monitor deadlines, and manage deliverables across teams.

- Who it’s for: Bookkeeping and accounting firms that need structure for recurring jobs and visibility across staff workloads.

Financial Cents worked well during testing for firms that manage recurring jobs. I built workflows for month-end closes and tax prep, and every job appeared on one dashboard with clear due dates. Tasks reset automatically once completed, which made recurring work predictable.

The automation is simple, but it’s steady. I liked how reminders kept staff accountable and how managers could track progress across multiple team members.

The system focuses on jobs, due dates, and simple automations, so setup stays under an hour for small teams. It’s not a full client portal, but it gets the essentials right.

Key features

- Workflow tracking: View all jobs and deadlines in one dashboard

- Recurring jobs: Automate monthly or quarterly tasks

- Client portal: Share updates and documents with clients

Pros

- Simple setup and intuitive navigation

- Great visibility across team workloads

- Affordable and scalable for small firms

Cons

- Limited customization for complex workflows

- Basic client portal compared to full-service tools

Pricing

Financial Cents starts at $19 per user per month for the Solo plan.

Bottom line

Financial Cents brings structure to recurring work without a heavy setup. It suits firms that prioritize task visibility and internal efficiency. Teams that need stronger client-facing tools might prefer Assembly or Canopy.

9. Client Hub: Best for QuickBooks and Xero users

- What it does: Client Hub is a client portal and task management app designed for bookkeeping teams. It integrates directly with QuickBooks and Xero to manage transaction questions, requests, and workflows.

- Who it’s for: Bookkeepers and accounting firms that work primarily in QuickBooks or Xero and want a simple way to collaborate with clients.

I tested Client Hub to see how it simplifies bookkeeping communication across accounting systems.

Sending transaction questions directly from QuickBooks Online worked smoothly, and the same process mirrored well in Xero. Clients replied within the portal, and their responses automatically synced back to the matching transactions inside each platform.

This two-way sync between Client Hub and accounting software made reconciliation faster and kept communication centralized. I liked how the dashboard showed which clients had replied and which still needed to respond, giving a clear view of progress.

It’s not a full workflow tool, but it delivers on its purpose. For firms that lose hours chasing missing receipts, it brings much-needed structure to daily bookkeeping.

Key features

- Accounting integrations: Connects with QuickBooks and Xero

- Client Q&A: Resolve uncategorized transactions in one place

- Task management: Organize jobs per client

Pros

- Great integration with accounting software

- Simplifies client communication around transactions

- Affordable for small bookkeeping teams

Cons

- Limited branding or customization

- Focused mainly on bookkeeping, not full firm management

Pricing

Client Hub starts at $49 per month for the Solopreneur plan.

Bottom line

Client Hub helps bookkeepers communicate directly with clients about transaction details. However, if you’re looking for broader workflows or reporting tools, you might want to consider Financial Cents or Karbon instead.

10. Moxo: Best for high-touch client service

- What it does: Moxo is a client interaction and collaboration platform that provides secure messaging, document exchange, and task tracking in branded client portals.

- Who it’s for: Accounting and advisory firms that manage high-value clients and want to deliver a more polished experience.

When I tested Moxo, I looked for how it could support high-touch accounting work like advisory projects or ongoing client reviews.

Setting up a workspace for client onboarding and document approvals was quick, and each step appeared clearly for both staff and clients. The structure made longer engagements easier to manage.

The branding tools stood out most. Firms can use their logo, colors, and custom domains to create a consistent client experience. Clients see one polished portal where they can message, upload files, and track milestones in real time.

Moxo isn’t designed specifically for accountants, but it adapts well. Once customized, it delivers a polished experience for firms that manage higher-value advisory relationships.

Key features

- Branded client portals: Custom workspaces for each client

- Secure communication: Encrypted chat and file sharing

- Workflow builder: Track milestones for each engagement

Pros

- Good presentation and branding control

- Secure and mobile-friendly

- Ideal for advisory-style firms

Cons

- Pricing not publicly listed

- Fewer accounting integrations

Pricing

Moxo offers custom pricing based on your needs.

Bottom line

Moxo helps firms deliver a premium, organized client experience through branded portals. It’s a strong fit for firms that prioritize communication and presentation. However, if automation or workflow tracking is more important, Karbon or Financial Cents could be a stronger fit.

11. Jetpack Workflow: Best for recurring job tracking

- What it does: Jetpack Workflow is a task and workflow management platform built for accounting firms. It tracks recurring jobs, due dates, and staff assignments across clients.

- Who it’s for: Firms that handle high volumes of repeat work, such as payroll, reconciliations, and reporting.

I tested Jetpack Workflow with a mix of recurring accounting jobs to see how it performed over time. Creating templates for monthly reconciliations, payroll, and tax deadlines was simple, and every job appeared in one clear dashboard view.

Reminders worked exactly as expected, keeping deadlines visible without overwhelming users. I appreciated how quickly new staff could learn the system since everything follows a consistent pattern. Reporting tools are light, but the tradeoff is speed and reliability.

For teams that manage recurring client work, Jetpack provides the consistency and visibility needed to keep jobs moving without constant oversight.

Key features

- Recurring workflows: Automate recurring accounting tasks

- Progress tracking: Monitor job status and due dates

- Reporting tools: Generate insights on job completion rates

Pros

- Reliable for recurring accounting cycles

- Clear visibility across teams and clients

- Easy setup for new users

Cons

- No built-in client communication features

- Limited integration list

Pricing

Jetpack Workflow starts at $30 per user per month for the Starter Yearly plan.

Bottom line

Jetpack Workflow helps accounting firms stay on top of recurring jobs and deadlines thanks to its workflows and progress tracking. However, if your firm needs client collaboration or messaging, Financial Cents or Liscio might be a better match.

12. HoneyBook: Best for proposals and payments

- What it does: HoneyBook is a client management platform that combines proposals, contracts, and invoicing in one workspace. It helps firms manage the early stages of client engagement.

- Who it’s for: Independent accountants and small firms that handle proposals, contracts, and payment collection.

When I tested HoneyBook, I focused on how it handles the early stages of client engagement. Building a flow with proposals, contracts, and payments took minutes, and each step connected smoothly from quote to invoice.

Automation managed follow-ups, reminders, and confirmations without needing extra setup. The client view displays every approval, document, and payment in one timeline, which makes progress easy to track. The modern design also helps clients move through the process with fewer questions or delays.

HoneyBook focuses on early engagement, not long-term workflows. For small firms or solo accountants, it offers a simple, professional way to start client relationships.

Key features

- Proposals and contracts: Send, sign, and convert into invoices

- Automations: Schedule follow-ups and reminders automatically

- Client portal: A simple space for clients to review and pay

Pros

- Easy to use and quick to set up

- Great for small firms and solo accountants

- All-in-one flow from proposal to payment

Cons

- Not built for large accounting teams

- Limited accounting integrations

Pricing

HoneyBook starts at $29 per month for the Starter plan.

Bottom line

HoneyBook gives smaller accounting teams an efficient way to manage client onboarding and payments. It’s simple and polished, especially for solo practitioners. If you need detailed workflows or document control, you may prefer Assembly or Karbon.

13. Bonsai: Best for solo accountants

- What it does: Bonsai is a lightweight CRM and client management tool with invoicing, contracts, and forms. It’s designed for freelancers and solo accountants managing smaller client lists.

- Who it’s for: Independent accountants and consultants who want an easy, all-in-one system for client communication and billing.

I used Bonsai to test how solo accountants could manage clients without extra tools. Setting up contracts, invoices, and payment reminders took just a few minutes. The templates cover most engagement types, so you can start quickly without designing new forms.

Everything lives in one dashboard, making it easy to see who’s paid and which projects are still open. The automation runs quietly in the background, sending invoices and reminders on time. It’s a light system that balances simplicity with control for everyday jobs.

It’s not made for multi-user firms, but that’s part of its strength. For individual accountants who want something organized and affordable, Bonsai keeps operations lean and reliable.

Key features

- Client CRM: Track client details and project status

- Contracts and invoices: Create, sign, and manage payments

- Templates: Use prebuilt forms for accounting engagements

Pros

- Affordable for solo practitioners

- Quick setup and clean interface

- Useful templates for engagements and billing

Cons

- Not built for multi-user teams

- Limited integration options

Pricing

Bonsai starts at $9 per user per month for the Basic plan.

Bottom line

Bonsai helps solo accountants manage proposals, contracts, and payments in one system. It’s best for independent professionals who want structure without heavy software. However, if you handle higher client volumes, you may prefer HoneyBook or Client Hub.

How I tested client portals for accountants

I spent a few months testing client portals used by accounting firms of all sizes, from solo practitioners to multi-partner offices. The goal was to see how each platform supports daily accounting work like client onboarding, document collection, billing, and collaboration.

Here’s what I evaluated:

- Setup and onboarding: How easy it was to create a client workspace, import contacts, and start sharing files without support.

- Client experience: Whether clients could review, sign, and pay without confusion or extra instructions.

- Workflow handling: How automation manages recurring jobs like bookkeeping, payroll, or tax prep.

- Team visibility: Whether managers could see what was in progress, overdue, or waiting on a client.

- Security and compliance: How tools protected financial data through encryption, permissions, and audit trails.

- Integrations and flexibility: How well each platform connected with QuickBooks, Xero, and other accounting software.

I also created mock firm environments, invited test clients, and ran full accounting cycles to see how the tools handled deadlines and client communication.

Which client portal for accountants should you choose?

Every firm manages clients differently, so the right client portal depends on how your team handles recurring work, billing, and communication. Choose:

- Assembly if you want a branded client experience that connects invoicing, agreements, and messages in one organized portal.

- Canopy if you need structured workflows and clear visibility across tax and bookkeeping jobs.

- TaxDome if you want strong automation for document collection, e-signatures, and recurring client cycles.

- Karbon if you run a growing team that manages many clients and needs accountability across deadlines.

- SmartVault if secure file sharing and audit-ready storage are top priorities.

- Liscio if you want fast, mobile-friendly client communication that replaces email.

- FuseBase if you care about presentation and need branded portals for deliverables or reports.

- Financial Cents if you prefer a lightweight system for tracking jobs and team workloads.

- Client Hub if your firm works primarily in QuickBooks or Xero and needs direct sync for client questions.

- Moxo if you handle high-value clients and want a polished, concierge-style experience.

- Jetpack Workflow if your focus is on recurring tasks like payroll, reconciliations, or month-end reporting.

- HoneyBook if you want a simple way to handle proposals, contracts, and payments in one flow.

- Bonsai if you’re a solo accountant looking for an affordable system that keeps invoicing and contracts organized.

My final verdict

Tools like Karbon and Financial Cents give firms visibility into recurring work, while TaxDome automates reminders and document collection during busy seasons. Liscio simplifies communication through mobile messaging, and SmartVault remains a trusted option for firms that prioritize security and compliance. Each one brings structure to a specific part of client management.

We built Assembly to bring those strengths together in one connected system. It combines billing, contracts, communication, and automation in a branded client portal that accountants can share with confidence. Clients see progress, sign documents, and pay invoices in one place, and teams stay focused on delivery instead of admin.

If your firm needs one platform that connects visibility, billing, and client experience without extra tools, Assembly is a good place to start.

Build a more connected client experience for your accounting firm with Assembly

Choosing the client portal for accountants means finding a system that simplifies collaboration while keeping every client detail in one place. Assembly gives accounting teams a secure hub for communication, billing, and documents so clients stay informed and your team stays organized.

Here’s what you can do with Assembly:

- See the full client record: Notes, files, payments, and communication history stay linked in one place. You never have to flip between systems or lose context when switching from sales to service.

- Prep faster for meetings: The Assistant pulls past interactions into a clear summary so you can walk into any call knowing exactly what’s been discussed and what’s next.

- Stay ahead of clients: Highlight patterns that may show churn risk or upsell potential, making outreach more timely and relevant.

- Cut down on admin: Automate repetitive jobs like reminders, status updates, or follow-up drafts that used to take hours. The Assistant handles the busywork so your team can focus on clients.

Ready to try an SPP.co alternative that organizes client work after the sale? Start your free Assembly trial today.

Frequently asked questions

What is an accounting client portal?

An accounting client portal is a secure online workspace where accountants and clients share files, send messages, and track payments. It replaces long email threads by keeping documents, invoices, and communication in one organized place.

Why do accountants need a client portal?

Accountants need a client portal to simplify document exchange and communication. It saves time, improves accuracy, and keeps all records secure for compliance while making collaboration easier for clients.

How do client portals keep accounting data secure?

Client portals protect accounting data through encryption, access controls, and audit trails. Only authorized users can view or upload files, keeping sensitive financial information safe and compliant.

Can small firms use an accounting client portal effectively?

Yes, small firms benefit from a client portal by saving hours on admin and client follow-ups. Even a single accountant can manage documents, collect signatures, and communicate more efficiently.

What features should you look for in a client portal?

You should look for e-signatures, document sharing, billing tools, and client messaging. These features help accountants manage recurring work, collect payments, and keep clients informed.

Your clients deserve better.

Try for free for 14 days, no credit card required.